Transfer Tax on properties being transferred through a sale gift or death. Be ready with Singpass 2-step verification 2FA to log in to e-Stamping Portal.

Synopsis Of Stamp Duty Kogi Irs

Sila hubungi meja bantuan STAMPS di stampshasilgovmy untuk sebarang pertanyaan lanjut.

. However if you have signed a document and stamped it within the following time frame no penalty will be charged. You should nominate your own bank account when setting up the RDI for the one-off payment. After you submit the return youll.

Filing your own Stamp Duty return online. Login to iTax Payments Payment Registration Tax head Agency Revenue Sub head Stamp Duty click payment type self assessment click on payment registration fill in bill reference number Nature of instrumentdetails of the transfer PIN details of the buyer PIN details of stamp duty Rate of instrument total amount to be paid Mode of. Pay Sellers Stamp Duty or claim for Sellers Stamp Duty Remission for Housing Developers for agreements relating to disposal of properties.

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. Party shall receive an assessment. The rates of duty vary according to the nature of the instruments and transacted values.

You are required to stamp a document before you sign it. Email your notification to stampdutymailboxhmrcgovuk. Welcome to FIRS - Integrated Stamp Duties Levies Services ISDLS.

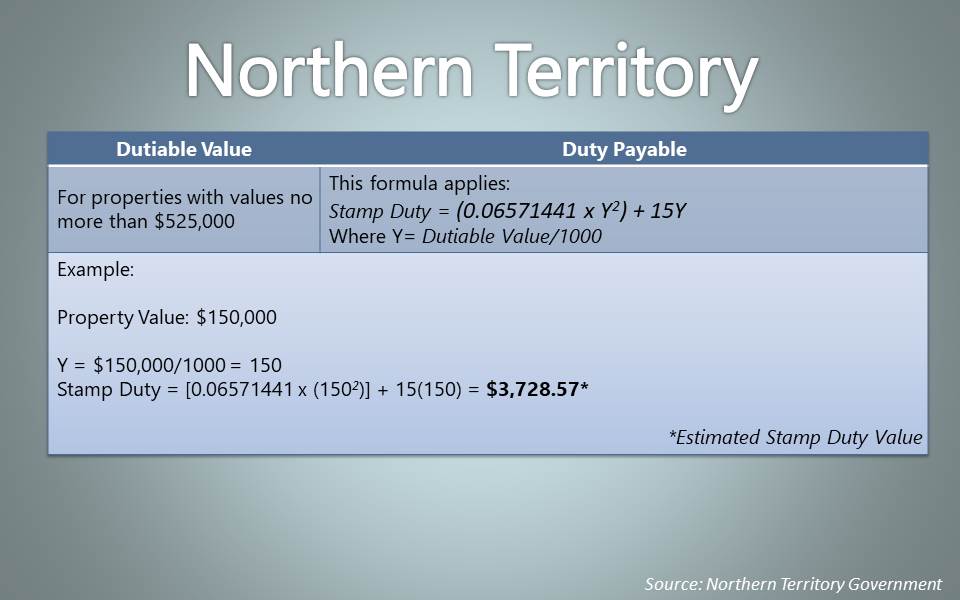

Stamp duty is tax that state and territory governments charge for certain documents and transactions. Dimaklumkan aktiviti penyelenggaraan STAMPS akan dijalankan pada. Motor vehicle registration and transfers.

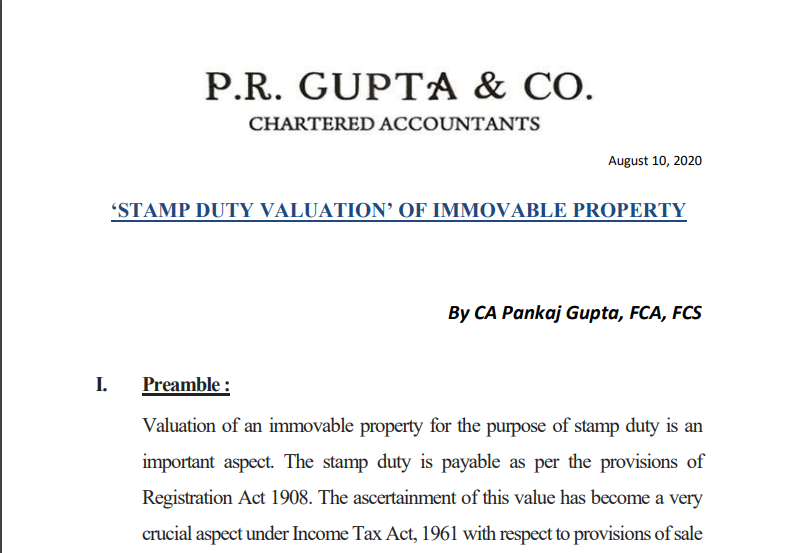

Stamp duty is computed based on the consideration paid or the market value of the property whichever is the higher amount. Thereafter the relevant party may at any time approach the Stamp Duty Office with the instrument to obtain. All you need is a registered account with us.

Assessment and payment of stamp duty can be made electronically via the Inland Revenues Stamp Assessment and Payment System STAMPS system. Payment of duty on the instrument can also be processed via digital payment platforms. Stamp Duty is a tax levied on legal instruments such as cheques receipts military commissions marriage licenses property and land transactions.

Deeds of Conveyance Deeds of Gift Deeds of Mortgage Release of Mortgage Loan Release of Life Insurance Policies Transfer of Shares Deeds of Lease Deed Polls Bonds and any other deeds require stamping. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Payment of Stamp Duty.

What stamp duty applies to. Subsequently the party will identify and select the type of instrument it intends to stamp from a pre-loaded category of instrument types and thereafter proceed to upload the relevant particulars of the instrument following which the party shall receive an assessment. Sale Purchase of Property Sellers Stamp Duty Note.

Documents are stamped as proof of the payment of Stamp Duty Transfer Taxes to make them legal and binding under the Law. Stamp Duty on a range of commercial and legal document according to the act. All instruments and transfer duty statements in the series of transactions should be lodged together or if lodged separately provide sufficient details so the bundles can be cross.

18102021 1000 Malam - 19102021 100 Pagi Sistem akan tidak dapat diakses pada waktu tersebut. Within 30 days after receiving the document in Singapore if the document is. Youll need to pay stamp duty for things like.

Stamp duty also differs based on other factors as mentioned above and it is important to check the relevant state government websites for the latest updates. If you perform e-Stamping frequently you may wish to sign up as a Registered User and enjoy additional features. The Commissioner General on receipt of the particulars or extracts shall assess the duty payable and issue a stamp for the purpose of the instrument on payment of the duty.

It is a payable in different rates depending on the nature of the instrument. The date of payment. The receipts of payment obtained at the conclusion of any transaction will act as the proof of payment of Stamp Duty.

You can use HMRCs Stamp Taxes Online free service or SDLT commercial software providers. The various available modes of stamp duty payment are. Transfers of property such as a business real estate or.

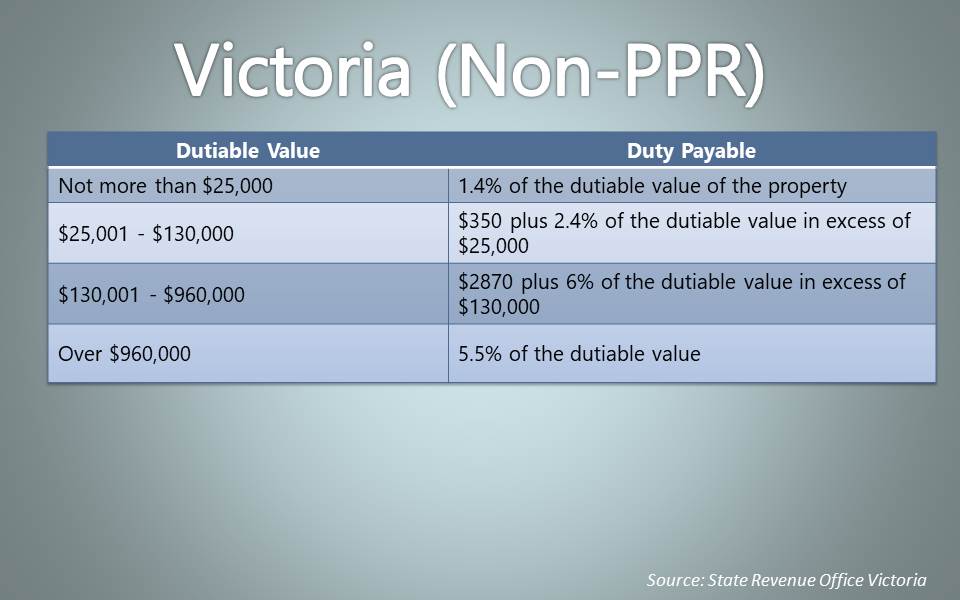

Duty is chargeable on the total of the dutiable values of each of the transactions and is determined at the time liability to duty arose on each transaction. Your email should include. Stamp Duty is a tax that you must pay when carrying out certain transactions that require legal documents.

The buyer must buy a physical stamp paper of the required amount from an authorised merchant. However under section 139 of the Ordinance if within one month from the date of the notice assessment the Collector of Stamp Revenue the Collector considers that the stamp duty so assessed is excessive he may cancel the assessment and make such assessment in substitution as. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

Where a person has provided the Commissioner General with an electronic address the Commissioner General may serve an assessment made through that address and therefore. Payment of duty on the instrument can also be processed via digital payment. The Ordinance does not contain any provisions about objection to assessments.

For transactional instruments that are prepared locally the tax should be paid within 30 days. If you are filing your own Stamp Duty return online through ROS you can set up a ROS Debit Instruction RDI to pay the duty. Within 14 days after signing the document if it is signed in Singapore or.

An electronic copy for example a scanned PDF. If you subsequently make a valid claim for a refund of Stamp Duty Revenue will make.

Online Step Wise Process To Pay Stamp Duty And Government Fees Online Faceless Compliance

Stamp Duty Valuation And Property Management Department Portal

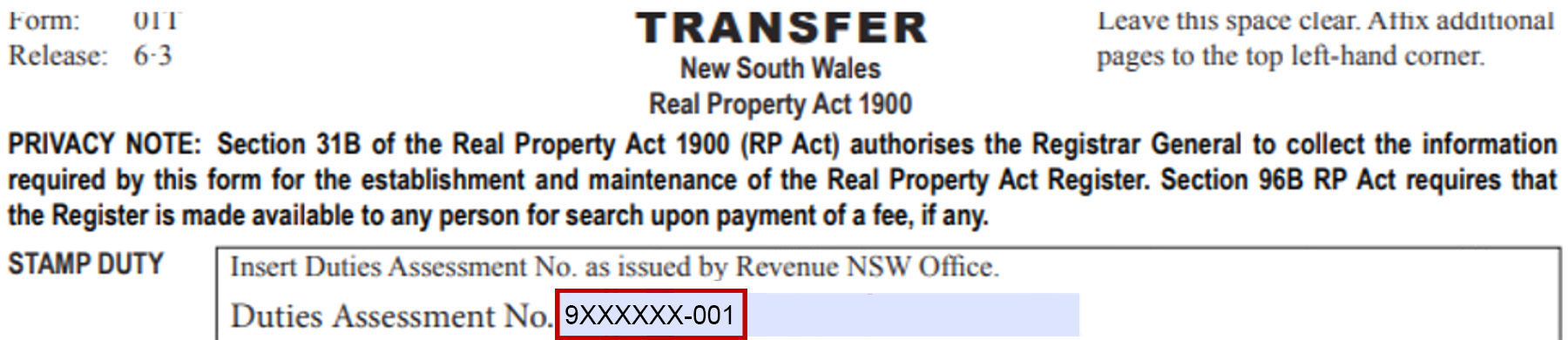

Endorsement Of Instruments Revenue Nsw

Property Exchange Australia Community Stamp Duty The E Conveyancing Community

How To Register Property Online In Kolkata Housing News

Stamp Duty Valuation Of Immovable Property

Property Exchange Australia Community Stamp Duty The E Conveyancing Community

Stamp Duty Calculator Queensland What Does Transfer Duty Cost In Qld

Pdf Property Transfer Tax And Stamp Duty

Wb Registration Of Land And Property All You Need To Know

Stamp Duty 101 Land Transfer Duty In Australia Your Mortgage

Stamp Duty 101 Land Transfer Duty In Australia Your Mortgage

Stamp Duty Registration Charges In West Bengal 2022 Calculation Payment

Endorsement Of Instruments Revenue Nsw

How To Calculate Stamp Duty Registration Fees On Property In Assam

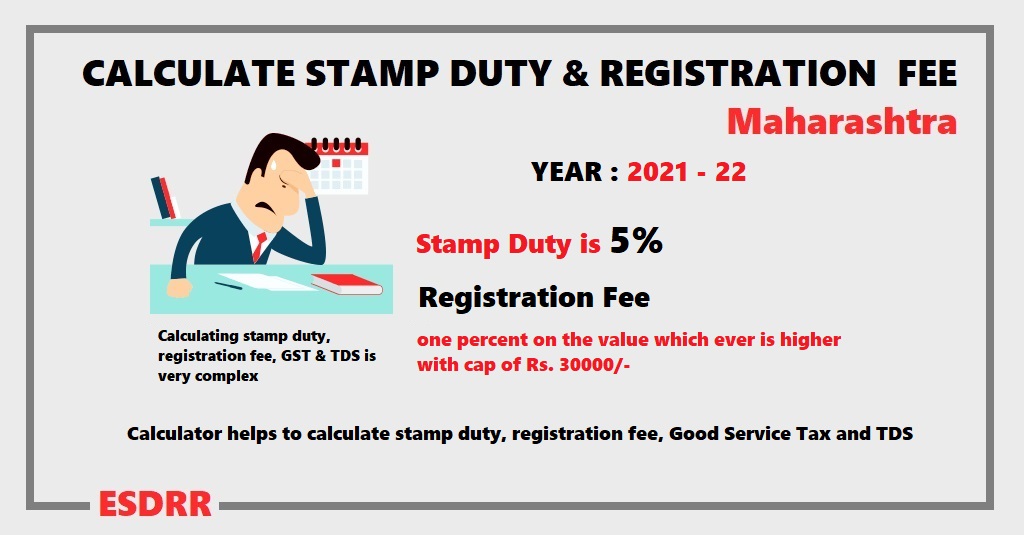

Stamp Duty And Registration Fee Calculator Mahrashtra

Endorsing Transactions As A Self Assessor Business Queensland